UFT Welfare Fund nest egg – bigger than most nests

A nest egg. A rainy day fund. A reserve. Back up. We all have some, or would like some. In case things go sideways, a way to pay some bills in the meantime.

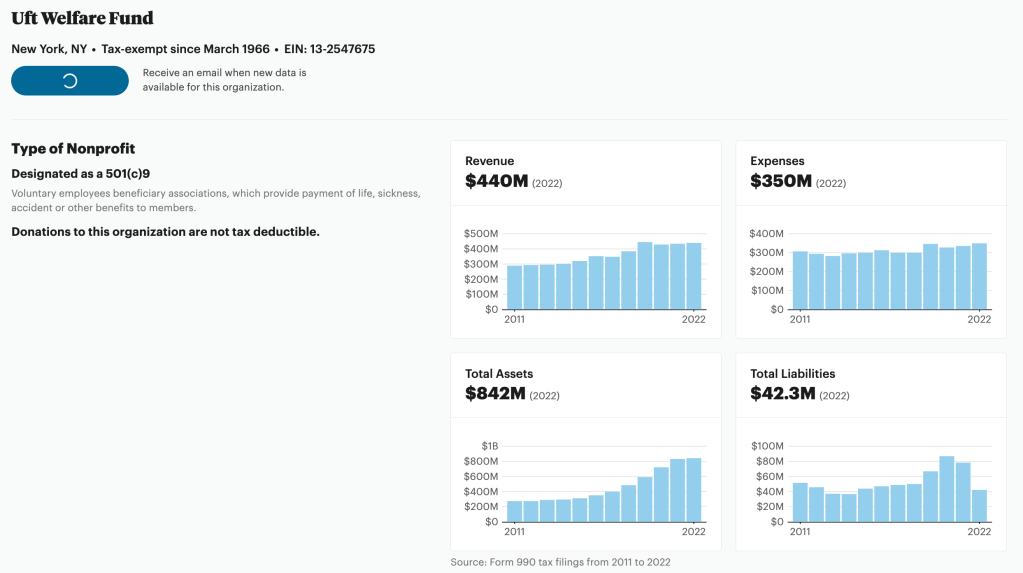

If you have assets that would cover a full year of expenses, that’s pretty good. And in 2011, the United Federation of Teachers Welfare Fund was about two-thirds of the way there: they had assets of $239 million, and expenses of $306 million. They also had revenue of $289 million. That means they lost a little, and the nest egg went down to $222 million.

As long as revenue and expenses were balanced, the assets (the rainy day fund, the nest egg, the reserve) stayed in that range. At the end of 2011 $222 million.

| Year | Assets |

| 2011 | $222 million |

| 2012 | $227 million |

| 2013 | $252 million |

| 2014 | $258 million |

| 2015 | $268 million |

Stable. Expenses surprisingly did not go up ($306 mil in 2011, $300 mil in 2015). This makes sense, right? I mean, to the extent that chunks of cash large enough to pay Donald Trump’s bond make sense. I don’t know about you, but I have trouble grasping just how much these numbers are. But however big they are – expenses not rising, revenue not rising, assets not rising, or just rising a little, that would seem to fit.

But look what happens next:

| Year | Assets |

| 2016 | $303 million |

| 2017 | $350 million |

| 2018 | $434 million |

| 2019 | $523 million |

| 2020 | $634 million |

| 2021 | $752 million |

| 2022 | $800 million |

What the?

Every year since 2016 the UFT Welfare Fund has taken in much more money than it has spent. Assets are doubling in 4-6 years? Wow.

Today, no answers. Just wow.

Revenue mostly comes from the City giving the Welfare Fund money, that the Welfare Fund then spends on administrative costs, and on us. Or, apparently, doesn’t spend. Those are some pretty hefty crumbs leftover.

Maybe 2014 was an inflection point. Maybe these huge increases have to do with the deal – when Mulgrew snuck into the contract provisions to cut health care (they call them health care “savings” – they save, we pay)

We should dig into more reports. Can you imagine putting fifty mil in the bank each year? And think about this. The Welfare Fund is saving money. Somehow. How?

Could it be that the eyeglass and ophthalmological reimbursements could be higher? Would that cut into the Welfare Fund eight hundred million?

Could it be that our dental plan, pretty lousy for a NYC union, is a discount plan – and that a plan like DC37s or the PSCs (note to self, let’s check other dental plans) would cut into that 9-digit UFTWF bankroll?

Look – I have a few questions now – no real answers. But before Mulgrew gets control of a cool billion, maybe we should dig into this. Maybe the Welfare Fund should be spending more money on, well, something worthwhile. Like our members’ welfare.

VOTE THEM OUT! :(